No Recession In Sight

Moderately softer growth rather than a recession looks likely in 2019 while subdued inflation and patient central bankers could allow the current economic cycle to stretch well into the next decade.Policy-makers are currently hampered by a lack of clarity about the degree that growth has slowed. Frontloading of trade ahead of tariffs, the U.S. government shutdown and Chinese New Year distortions have all made the data hard to read. This results in an unhealthy reliance on “softer” measures of confidence, which could have been affected by financial market volatility. This should be a short-term problem and the smoke should clear by 2Q 2019.

The news flow over the past month has been encouraging. U.S. confidence indicators have bounced, Chinese credit growth has picked up (suggesting policy traction) and East Asian trade data for January has been running ahead of expectations.

Another way to look at the data is to ask whether economic releases have been stronger or weaker than expected. These “surprise indicators” have been showing disappointments in Europe, but not in other major developed economies.

Source: Bank of Singapore

Source: Bank of Singapore

United States

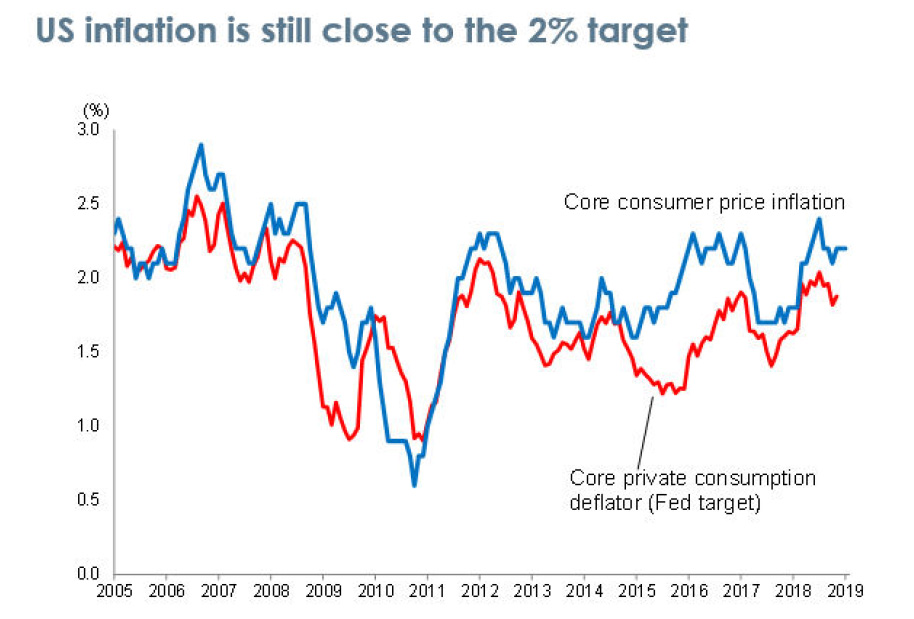

Financial market turbulence and the government shutdown appears to be behind volatility in some of the economic data releases, but without raising serious concern about the threat of recession. Fiscal policy is still loose – with more tax rebates to come – while the Fed has given assurances that it will not squeeze activity through punitive interest rates. Despite accelerating wage growth, inflation remains subdued, which gives policy-makers the confidence to continue to pursue growth-oriented policies.

Source: Bank of Singapore

Source: Bank of Singapore

Trade policy remains a risk, with a low degree of predictability. The record U.S. trade deficit continues to widen – a trend that is unlikely to be reversed by Chinese assurances to increase imports in some areas – and as a result, renewed friction will never be far away.

Europe

The Eurozone economy remains dull in early 2019, having seen growth dip below 1 per cent in late 2018. Political turmoil in France as well as Italy appears to have damaged business confidence, although this is partly offset by looser fiscal policy as the governments try to placate the discontents. Signs of weakness are mainly driven by temporary factors, which should allow growth to rebound to some degree in coming months.

The choice of ECB President Draghi’s replacement is likely in 2Q 2019, ahead of the end of his term in office in October. This could drive expectations of the timing of the first move on interest rates, as the “whatever it takes” assurance is no longer necessary. The ECB is institutionally more hawkish than the Fed, but even so, a rate-hike this year is looking unlikely as core inflation remains stuck at around 1%.

The U.K. is being hampered by Brexit-related uncertainty, but so far, the damage is not particularly pronounced. Serious short-term pain would come from a “no deal” departure at the end of March, but this is something that Parliament has the ability (and apparent determination) to avoid, by delaying the process if necessary.

Japan

Automobiles account for nearly 40 per cent of exports to the U.S., so Japan will be watching the risk of tariffs closely, especially as some areas are already being affected by collateral damage from the U.S.- China dispute. Otherwise, the outlook is solid as activity has rebounded after various natural disasters hurt growth in 3Q 2018. The 2 per cent rise in the sales tax planned for October will be the next hurdle, but a range of counter-measures mean this should not cause more than a short-term fluctuation.

Inflation remains subdued and the Bank of Japan is likely to be more “patient” than any of the other central banks in major developed markets.

China

Early signs of the impact from policy stimulus are becoming apparent in infrastructure spending and credit growth, but so far this has not been enough to offset the drag coming from trade friction. A more positive interpretation is that the various measures already announced have successfully prevented much of a hit to growth, with manufacturing PMIs barely below 50, while the non-manufacturing side remains comfortably positive.

Trade barriers – broadly defined – remain the most immediate threat. This is not just tariffs on Chinese exports to the U.S., but also loss of access to Western technology and perhaps even a reduced ability to subsidize specific industries. Even assuming the current round of talks avoids any escalation, the risk of renewed tension will never be far away as the US position has shifted to be more deliberately uncooperative.

Emerging markets

Aside from the risk of being accidental bystanders in any escalation of trade friction, the outlook for emerging markets looks reasonably bright. A “patient” Fed should take some of the pressure off exchange rates and allow some central banks to think about loosening policy. Elections are always a concern – in India and Indonesia in coming months – but signals point to continuation of the status quo.

Any opinions or views expressed in this material are those of the author and third parties identified, and not those of OCBC Bank (Malaysia) Berhad (“OCBC Bank”, which expression shall include OCBC Bank’s related companies or affiliates).

The information provided herein is intended for general circulation and/or discussion purposes only and does not contain a complete analysis of every material fact. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product.

In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

OCBC Bank, its related companies, their respective directors and/or employees (collectively ‘Related Persons’) may have positions in, and may effect transaction in the products mentioned herein. OCBC Bank may have alliances with the product providers, for which OCBC Bank may receive a fee. Product providers may also be Related Persons, who may be receiving fees from investors. OCBC Bank and the Related Person may also perform or seek to perform broking and other financial services for the product providers.

All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.