Less Bullish On Asia

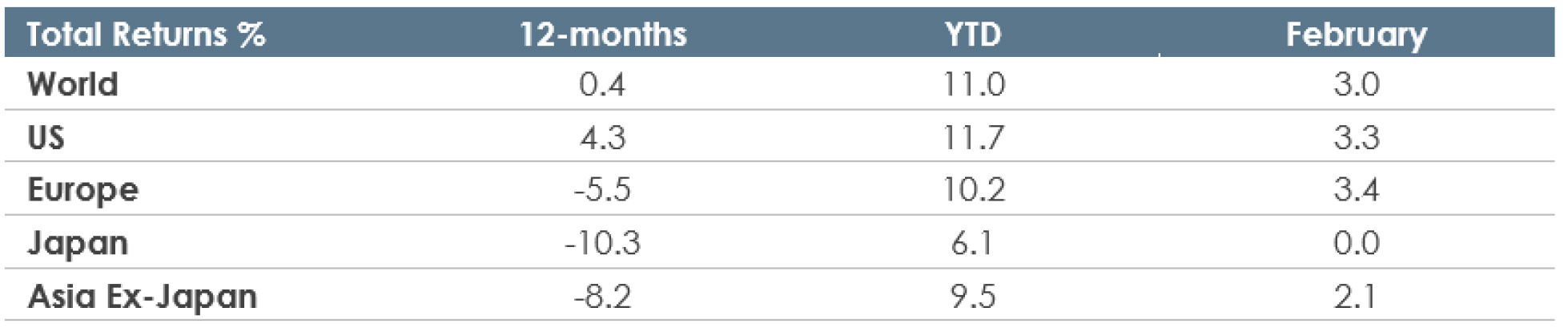

Recovery in Asia has made equity valuations less compelling. While valuations are far from expensive, the margin of safety is much narrower compared to its global peers.Buoyed by growing optimism from the Fed pause and the U.S.-China trade war truce, global equities extended their recovery into February. We are now just 5 per cent below the all-time peak in September. Near-term, the dovish Fed and more realistic growth expectations remain supportive for equities, even as valuations are no longer as undemanding.

Earnings growth outlook and the pace of U.S. inflation will remain the focus. We maintain the view that peak valuation multiples for global equities are behind us. While China and the U.S. are now expected to reach new deals, differences are likely to persist and could contribute to renewed market volatility. With the run-up, we see more limited upside potential for Asia Ex-Japan. On the other hand, Europe is looking relatively more attractive.

As such, earnings growth outlook would remain the focus. Geopolitical events, especially the US-China trade spat, would continue to cloud the growth outlook and contribute to market volatility. In addition to the global growth trajectory, the pace of US inflation is another key macro driver to watch.

United States

U.S. equities continued to lead the recovery in February. Besides improving US-China trade talks, growing expectations that the Fed’s balance sheet run-off would be ended pre-maturely boosted risk appetite. While the earnings season surprised positively, equity analysts further trimmed their EPS expectations for 2019. Together with last year’s high base, year-on-year EPS growth continues to moderate. Also, the U.S. remains the most expensive amongst major equity markets. With financial markets now pricing-in the end of the tightening cycle, U.S. inflation outlook remains a key risk.

Eurozone

European equities rode the rebound in risk appetite despite the lacklustre growth outlook. Nevertheless, as the ongoing weakness is partly driven by temporary factors, growth should start to recover in the coming months. Coupled with less demanding valuations, the region could start to catch up. U.S. auto tariffs and European parliamentary elections which could reinforce populist parties remain ongoing risks.

Japan

Japanese equities lagged again in February. Near term, plans to roll out offsetting measures ahead of the impending hike in consumption tax in October should boost growth. Meanwhile, valuations are attractive and discounting weak growth expectations. Also, the improving corporate governance does not seem to be reflected in relative valuations. Longer-term growth backdrop remains an issue given capacity shortages and increasingly limited policy options.

Asia ex-Japan

Growing confidence that China’s more active stimulus actions would help rejuvenate domestic growth boosted investor risk appetite further. Furthermore, reduced trade tensions helped. The extension beyond 1 March of the tariff hike pause on US$200b of Chinese imports provided a major boost. With this backdrop, North Asian markets of Hong Kong, Taiwan and China, not surprisingly, outperformed in February. A-shares rebounded sharply. Near-term, a dovish Fed and supportive China policymakers should continue to buoy sentiment. Growing expectations of a potentially smaller Fed balance sheet unwind provide a positive setting.

On the other hand, following the sharp recovery, the valuation gap between Asia Ex-Japan equities and global peers has closed. As such, we see more limited outperformance for the region from here. At the same time, with markets discounting optimism in the U.S.-China trade negotiations, any hiccups could contribute to renewed market volatility.

Singapore

For MSCI Singapore, valuations have moved up from 11.4x FY19 earnings at the beginning of the year to 12.5x currently. We do not think this is demanding but will wait for better price levels to re-enter the market.

With the strong gains so far this year, we believe there is a better chance to enter the market during price pullback, especially since volatility will remain from the trade front.

China

A more dovish Fed policy path and ongoing U.S.-China trade negotiations have been supportive for risky assets, with MSCI HK and MSCI China rebounding 5.9 per cent and 3.5 per cent, respectively, over the past month. China A-shares (Shanghai Composite Index) rallied 13.8 per cent, thanks in part to strongerthan- expected January credit data with overall credit growth rebounded to 10.3 per cent year-on-year after declining for 18 months.

MSCI announced in late February the decision to increase China A-share’s weightings in its indices. Based on MSCI’s estimates, A-shares’ weight in MSCI Emerging Market Index will be lifted from the current 0.7% to 2.8% in August 2019 and will further be raised to 3.4% in May 2020. Year-to-date, A-share market has recorded strong foreign fund inflows of RMB112bn via the Northbound Stock Connect (vs. RMB294bn in 2018 and RMB200bn in 2017).

Any opinions or views expressed in this material are those of the author and third parties identified, and not those of OCBC Bank (Malaysia) Berhad (“OCBC Bank”, which expression shall include OCBC Bank’s related companies or affiliates).

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product.

In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

OCBC Bank, its related companies, their respective directors and/or employees (collectively ‘Related Persons’) may have positions in, and may effect transaction in the products mentioned herein. OCBC Bank may have alliances with the product providers, for which OCBC Bank may receive a fee. Product providers may also be Related Persons, who may be receiving fees from investors. OCBC Bank and the Related Person may also perform or seek to perform broking and other financial services for the product providers.

All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.