OCBC Booster Account-i

Give your savings a boost when you combine it with your wealth.

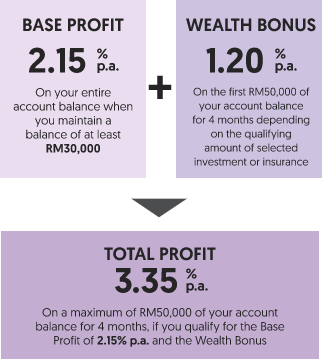

As an example, if you maintain an account balance of RM30,000 and qualifies for the Wealth Bonus on the first RM50,000, the Effective Profit Rate for a 4-month period is 3.35% p.a.

Enjoy no lock-in period on your funds and MEPS fee waiver for the first 2 withdrawals every month.

Terms and conditions apply.

Enjoy the wealth bonus of 1.20% p.a. for 4 months when you invest in any new eligible wealth product from OCBC Al-Amin of at least:

Enjoy the wealth bonus of 1.20% p.a. for 4 months when you invest in any new eligible wealth product from OCBC Al-Amin of at least:

| Eligible Wealth Product | Starting From |

|---|---|

| Unit Trust-i lump sum investment |

RM20,000

|

Note: To ensure that the product you subscribe to meets your financial needs, our Personal Financial Consultant will perform a Financial Needs Analysis with you in order to help you make an informed

decision.

- The wealth bonus is accorded for 4 months. The wealth bonus is accorded after either (i) the cancellation period ends; or (ii) 14 days after the effective date of subscription, whichever is later. Effective date refers to the trade date of Unit Trust-i.

- The wealth bonus will be paid on the first RM50,000 of your account's average daily balance. You will receive it by the 14th business day of the following month.

- Minimum sales charge for eligible unit trust-i investments is 2.75%.

- The 2 MEPS withdrawal fee waiver is promotional and valid until 31 December 2023.

- If you qualify for the wealth bonus more than once in the same month, you will enjoy the maximum wealth bonus of 1.20% p.a. from the effective date of subscription of the latest eligible wealth product.

- You need to be the primary account holder of OCBC Booster Account-i as well as the primary account holder of the eligible investment product.

Non-Residents (subject to the country of origin)

Questions you may have

1 How different is the OCBC Booster Account-i from other savings account-i?

The OCBC Booster Account-i is a savings account that rewards you with a high base profit rate when you maintain an account balance of RM30,000 and above. In addition, it rewards you with wealth bonus when you invest with OCBC Al-Amin.

2 How is the profit calculated?

You get 2 types of profit on your account balance every month.

a) Base profit: This profit is accrued daily based on your account's day-end balance and you will receive this at the end of the month.

b) Wealth bonus: This profit is based on the first RM50,000 of your account's average daily balance and you will receive this by the 14th business day of the following month or earlier; truncated

to 2 decimal places. No wealth bonus will be paid to your Booster Account-i if the total amount of bonus in such month is less than RM0.01.

3 What will happen when my account balance falls below RM30,000?

The base profit of 0.10% p.a. will be accrued based on the days where your account balance falls below RM30,000.

For example: If you have maintained your account balance below RM30,000 between the 1st - 15th of the month, then your base profit accrued for this account balance will be 0.10% p.a. from 1st

- 15th of the month. Subsequently, if you maintain your account balance at or above RM30,000 between the 16th - 31st of the month, then your base profit accrued for this balance will be 2.15% p.a. from

the 16th - 31st of the month.

| Dates | Account balance | Base profit accrued |

|---|---|---|

| 1-15 Aug | RM28,000 | 0.10% p.a. |

| 16-31 Aug | RM32,000 | 2.15% p.a. |

4 Can I open more than one OCBC Booster Account-i?

You may only open ONE OCBC Booster Account-i whether in own name or in joint names, where you are the primary account holder.

5 Can I use the money in my OCBC Booster Account-i?

Yes, you can. There is no holding period for this account. You can withdraw money with a debit card/-i and/or access your money through OCBC Online Banking.

6 Where can I withdraw money from my OCBC Booster Account-i?

You can withdraw money from any ATM operated by OCBC such as OCBC Bank Singapore, OCBC Bank Malaysia Berhad, OCBC Al-Amin Bank Berhad, OCBC NISP (Indonesia) and OCBC Wing Hang (Hong Kong and Macau) at no charges.

You can also withdraw from any ATM within the MEPS network where your MEPS fee for the first 2 withdrawals of each month will be waived. Subsequent withdrawals will be charged at up to RM1.00

per withdrawal.

For the latest fees and charges, please click here

1 How do I qualify for the wealth bonus?

You need to invest in any eligible wealth product of at least the minimum amount with OCBC Al-Amin Bank. Only subscriptions made from 18 December 2020 onwards will be eligible.

Note: To ensure that the product you subscribe meets your financial needs, our Personal Financial Consultant will perform a Financial Needs Analysis with you in order to help you make an informed

decision.

2 When will I receive the wealth bonus?

This wealth bonus is accorded for 4 months. Payment starts after the month in which either (i) the cancellation period ends; or (ii) after 14 days have passed after the effective date of subscription, whichever is later. Effective date of subscription

refers to the trade date of Unit Trust-i.

For example:

| Effective date of subscription | Date after cancellation period or 14 days from effective date of subscription | First month of wealth bonus |

|---|---|---|

| 1 January | 15 January | January (Wealth bonus will be credited in February) |

| 20 January | 4 February | February (Wealth bonus will be credited in March) |

3 How will I know that the base profit is credited to my OCBC Booster Account-i?

Your base profit will be reflected in your statement, Online Banking and Mobile Banking transaction history as PROFIT CREDIT.

4 How will I know that the wealth bonus is credited to my OCBC Booster Account-i?

Your wealth bonus will be reflected in your statement, Online Banking and Mobile Banking transaction history as WEALTH BONUS.

If you close your account before the wealth bonus crediting date, the wealth bonus for the previous month will be forfeited.

5 How will my wealth bonus be accounted for if I have more than RM50,000 in my account balance?

You will continue to enjoy your wealth bonus of 1.20% p.a. on the first RM50,000 of your OCBC Booster Account-i's average daily balance.

Additionally, you will still earn the base profit of 2.15% p.a. on your entire account balance.

6 Can I combine the multiple wealth product subscription to qualify for the wealth bonus?

Yes, you can. Subscription of the same wealth product meeting the minimum eligibility criteria can be accumulated if their effective date of subscription, after the cancellation period or 14 days whichever is later, falls in the same calendar month.

For example:

| Qualify for wealth bonus? | ||

|---|---|---|

| RM 20,000 | Yes | |

| RM 15,000 | ||

|

10 April

RM15,000 lump sum investment in Unit Trust-i A at 2.75% sales charge |

20 May

RM5,000 lump sum investment in Unit Trust-i B at 2.75% sales charge |

RM 20,000 |

7What happens if I qualify for the wealth bonus more than once and the bonus periods overlap?

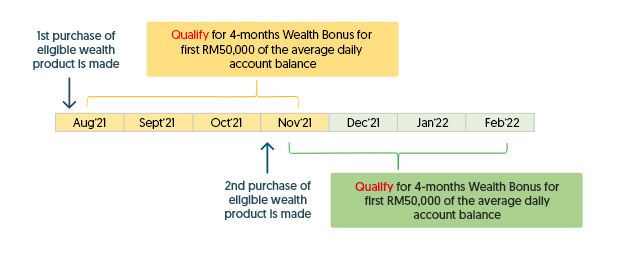

If you qualify for the wealth bonus 18 December 2020 onwards, for months in which there are overlaps, you will enjoy the maximum wealth bonus of 1.20%p.a. from the effective date of the latest eligible wealth product for 4 months.

Scenario

You purchase wealth product X in August 2021 and are eligible for 1.20%p.a. wealth bonus for 4 months (i.e., until November 2021). In October 2021, you purchase product Y and are eligible for 1.20%p.a. wealth bonus for 4 months. With this, you will receive the wealth bonus of 1.20%p.a. until January 2022, i.e., the latest qualifying month of the wealth bonus.

8 How long can I enjoy the wealth bonus for if I qualify for it?

As long as you have subscribed to an eligible wealth product with an effective date of subscription, you will enjoy the wealth bonus according to the predetermined period below:

| Eligible wealth product | Wealth bonus earned |

|---|---|

| Unit Trust-i lump sum investment |

4 months for eligible wealth products purchased from 18 December 2020 onwards |

9 Do I continue to get this wealth bonus if I redeem my investments?

Yes. You will continue to get this wealth bonus.

10 Do I continue to get this wealth bonus if I cancel my investment during the cancellation period?

No, you will not be eligible for the wealth bonus. The wealth bonus is accorded for only after the effective date of subscription, after the cancellation period or 14 days, whichever is later.

11 How can I pay for the eligible wealth products?

There are many ways to pay for eligible wealth products:

Unit Trust-i (lump sum investment): Cash, Auto Debit (via OCBC account) or EPF account for applicable funds

12 Where can I find more information on the eligible wealth products?

13 What are the financial products excluded from wealth bonus?

These are examples of financial products that do not qualify for wealth bonus:

Financing Facility

Foreign Exchange (FX)

Takaful term plans

OCBC ARIP-i

14 If I have multiple Booster accounts-i, which account will my wealth bonus be paid to?

The wealth bonus will be paid to the account with the higher bonus amount. In the event the wealth bonus amount is the same for several accounts, then the wealth bonus will be paid to the account with the largest account number.

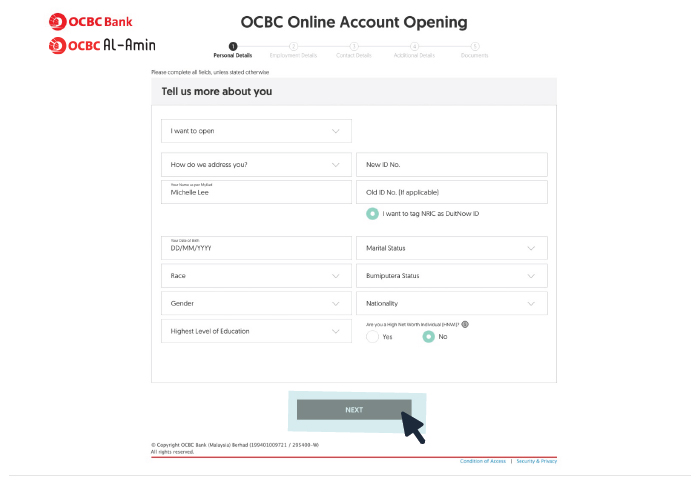

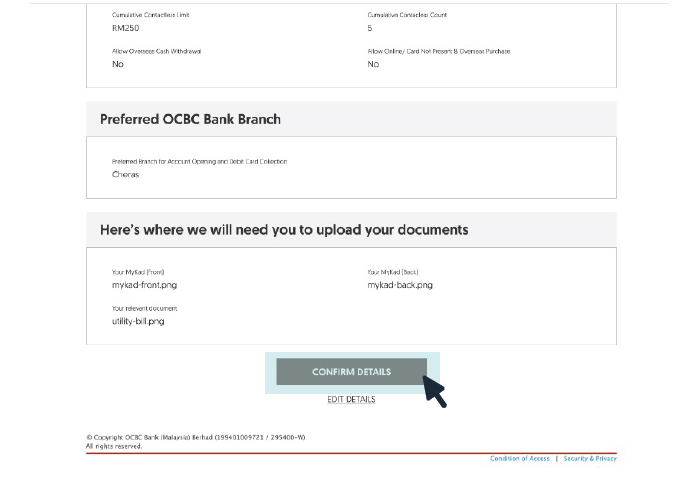

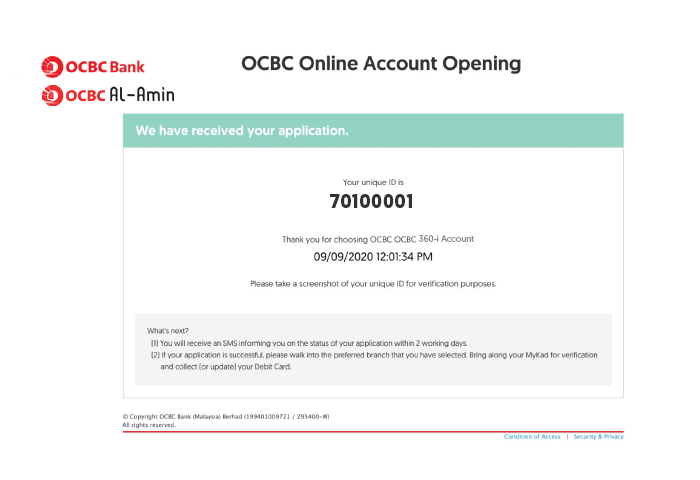

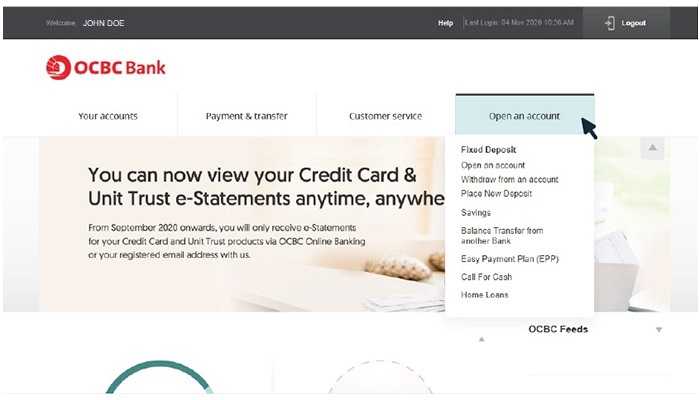

Ways to apply

During this MCO, please select a branch within your district so you can drop in within 8 business days to verify your account once it is successfully opened.

for us to meet up and better assist you.

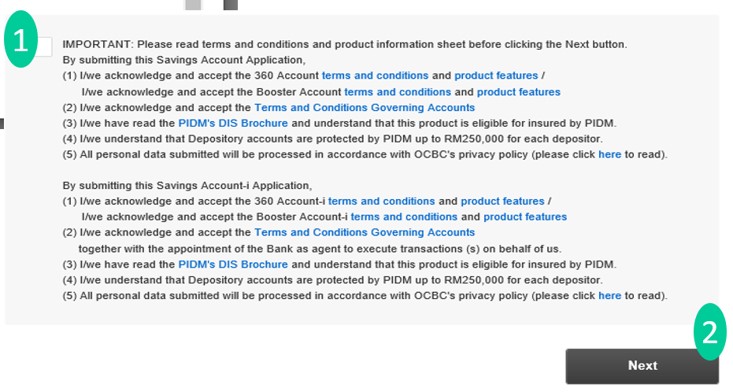

- Terms and Conditions Governing the OCBC Booster Account-i EN BM

- Product Information Sheet EN BM

- Wealth Bonus Appendix for Booster Account-i EN BM

- Terms and Conditions Governing Accounts

- Protected by PIDM up to RM250,000 for each depositor

- Important Notice for Unit Trust-i