- How different is the OCBC Booster Account from other savings account?

The OCBC Booster Account is a savings account that rewards you with a high base interest rate when you maintain an account balance of RM30,000 and above. In addition, it rewards you with "wealth" bonus interest when you do any of these:

- Invest with OCBC

- Insure with OCBC

- How is the interest calculated?

You get 2 types of interest on your account balance every month.

- Base interest: This interest is accrued daily based on your account's day-end balance and you will receive this at the end of the month.

- Wealth bonus: This interest is based on the first RM50,000 of your account's average daily balance and you will receive this by the 14th business day of the following month or earlier; truncated to 2 decimal places. No wealth bonus will be paid to your Booster Account if the total amount of bonus in such month is less than RM0.01.

- What will happen when my account balance falls below RM30,000?

The base interest of 0.10% p.a. will be accrued based on the days where your account balance falls below RM30,000.

For example: If you have maintained your account balance below RM30,000 between the 1st - 15th of the month, then your base interest accrued for this account balance will be 0.10% p.a. from 1st - 15th of the month. Subsequently, if you maintain your account balance at or above RM30,000 between the 16th - 31st of the month, then your base interest accrued for this balance will be 2.15% p.a. from the 16th - 31st of the month.

Dates Account Balance Base Interest accrued 1 -15 Aug RM28,000 0.10% a year 16 - 31 Aug RM32,000 2.15% a year - Can I use the money in my OCBC Booster Account?

Yes, you can. There is no lock-in period for this account. You can withdraw money with a debit card and/or access your money through OCBC Online Banking.

- Where can I withdraw money from my OCBC Booster Account?

You can withdraw money from any ATM operated by OCBC Group, comprising of OCBC Bank in Malaysia & Singapore, OCBC Al-Amin Bank, OCBC NISP (Indonesia) and OCBC Wing Hang (Hong Kong and Macau) at no charges.

You can also withdraw from any ATM within the MEPS network where your MEPS fee for the first 2 withdrawals of each month will be waived. Subsequent withdrawals will be charged at up to RM1.00 per withdrawal.

For the latest fees and charges, please click here

OCBC BOOSTER ACCOUNT

Fast-track the path to your desired lifestyle. Earn up to 4.15% p.a.

Kick start your wealth journey today.

Campaign period: 1 April 2025 - 31 December 2025 (both dates inclusive)

As an example, if you maintain an account balance of RM30,000 and qualify for the Wealth Bonus on the first RM50,000, the Effective Interest/Profit rate for a 4-month period is 4.15% a year.

Enjoy no lock-in period on your funds and MEPS fee waiver for the first 2 withdrawals every month.

Terms and conditions apply.

Enjoy up to 3.35% maximum Interest/profit a year on your savings with no lock-in period.

As an example, if you maintain an account balance of RM30,000 and qualify for the Wealth Bonus on the first RM50,000, the Effective Interest/Profit rate for a 4-month period is 3.35% a year.

Enjoy no lock-in period on your funds and MEPS fee waiver for the first 2 withdrawals every month.

Terms and conditions apply.

Enjoy the promotional wealth bonus for 4 months when you invest in any new eligible wealth product from OCBC of at least:

|

|

To ensure that the product you purchase meets your financial needs, our Personal Financial Consultant will perform a Financial Needs Analysis with you in order to help you make and informed decision.

- The wealth bonus is accorded for 4 months after either (i) the free look / cancellation period ends: or (ii) 14 days after the effective date of purchase, whichever is later. Effective date refers to the inception date of the insurance product and trade date of unit trust.

- The wealth bonus will be paid on the first RM50,000 of your account's average daily balance. You will receive it by the 14th business day of the following month.

- Minimum sales charge for eligible unit trust investment is 2.75%.

- The 2 MEPS withdrawal fee waiver is promotional and valid until 31 December 2025.

- If you qualify for the wealth bonus more than once in the same month, you will enjoy the wealth bonus from the effective date of purchase of the latest eligible wealth product.

- You need to be the primary account holder of OCBC Booster Account as well as the policy owner of the eligible insurance product or primary account holder of the eligible investment product.

Enjoy the promotional wealth bonus for 4 months when you invest in any new eligible wealth product from OCBC of at least:

|

|

To ensure that the product you purchase meets your financial needs, our Personal Financial Consultant will perform a Financial Needs Analysis with you in order to help you make and informed decision.

- The wealth bonus is accorded for 4 months after either (i) the free look / cancellation period ends: or (ii) 14 days after the effective date of purchase, whichever is later. Effective date refers to the inception date of the insurance product and trade date of unit trust.

- The wealth bonus will be paid on the first RM50,000 of your account's average daily balance. You will receive it by the 14th business day of the following month.

- Minimum sales charge for eligible unit trust investment is 2.75%.

- The 2 MEPS withdrawal fee waiver is promotional and valid until 31 December 2025.

- If you qualify for the wealth bonus more than once in the same month, you will enjoy the wealth bonus from the effective date of purchase of the latest eligible wealth product.

- You need to be the primary account holder of OCBC Booster Account as well as the policy owner of the eligible insurance product or primary account holder of the eligible investment product.

Discover how much interest/profit you can earn

Calculate your interest/profit

Base rate1

0.00% a year

Base interest/profit per month

RM0.00

Promotional Wealth Bonus rate2

Up to first RM50,000 only

0.00% a year

Wealth Bonus amount per month

RM0.00

Here is how much interest/profit you earn

Total interest/profit per month

RM0.00

4-month effective interest/profit rate

0.00%

Disclaimer

The amount is calculated on per month (31 days) basis and is for illustration purposes only.

1Base interest/profit per month is calculated based on account daily balance and will be paid on monthly basis.

2Wealth bonus per month is calculated based on account average balance and will be paid on monthly basis.

The calculator is for your convenience only and you have chosen to use it and rely on any results at your own risk. OCBC Bank will not under any circumstances accept responsibility or liability for any losses that may arise from a decision that you may make as a result of using the calculator.

Discover how much interest/profit you can earn

Calculate your interest/profit

Base rate1

0.00% a year

Base interest/profit per month

RM0.00

Wealth Bonus rate2

Up to first RM50,000 only

0.00% a year

Wealth Bonus amount per month

RM0.00

Here is how much interest/profit you earn

Total interest/profit per month

RM0.00

4-month effective interest/profit rate

0.00%

Disclaimer

The amount is calculated on per month (31 days) basis and is for illustration purposes only.

1Base interest/profit per month is calculated based on account daily balance and will be paid on monthly basis.

2Wealth bonus per month is calculated based on account average balance and will be paid on monthly basis.

The calculator is for your convenience only and you have chosen to use it and rely on any results at your own risk. OCBC Bank will not under any circumstances accept responsibility or liability for any losses that may arise from a decision that you may make as a result of using the calculator.

Eligibility requirements

Minimum age

18 and above

Nationality

Malaysian Citizens, Permanent Residents and Non-residents (subject to the country of origin)

Deposit requirements

Initial deposit

RM500

Minimum balance to maintain in account

RM20 (Any transaction resulting in the balance falling below the minimum balance will be rejected)

Statements

Monthly statements

Paper or e-Statement

Terms and conditions

Important notices

PIDM disclosure

This deposit is protected by PIDM up to RM250,000 for each depositor.

- Deposit protection is automatic.

- PIDM protects depositors holding deposits with banks.

- There is no charge to depositors for deposit insurance protection.

- Should a bank fail, PIDM will promptly reimburse depositors over their deposits.

For more information, refer to PIDM's DIS Brochures that are available at our counters or go to the website at www.pidm.gov.my.

Open your OCBC Booster Account today

or visit us at a branch near you.

Common Questions

- How do I qualify for the wealth bonus?

You need to invest in any eligible wealth product of at least the minimum amount with OCBC Bank. Only purchases made from 18 December 2020 onwards will be eligible.

Note: To ensure that the product you purchase meets your financial needs, our Personal Financial Consultant will perform a Financial Needs Analysis with you in order to help you make an informed decision.

- When will I receive the wealth bonus?

This wealth bonus is accorded for 4 months. Payment starts after the month in which either (i) the free look/cancellation period ends; or (ii) 14 days have passed after the effective date of purchase, whichever is later. Effective date of purchase refers to the inception date of the insurance product and trade date of unit trust.

For example:

Effective date of purchase Date after free look / cancellation period of 14 days from effective date of purchase First month of wealth bonus 1 January 15 January January

(Wealth bonus will be credited in February)

20 January 2 February February

(Wealth bonus will be credited in March)

- How will I know that the base interest/ wealth bonus interest are credited to my OCBC Booster Account?

Your base & wealth bonus interest will be reflected in your statement, Online Banking and Mobile Banking transaction history as INTEREST CREDIT (base interest) and WEALTH BONUS.

If you close your account before the wealth bonus crediting date, the wealth bonus for the previous month will be forfeited.

- Can I combine the multiple wealth product purchases I made to qualify for the wealth bonus?

Yes, you can. Purchases of the same wealth product meeting the minimum eligibility criteria can be accumulated if their effective date of purchase, after the free look/ cancellation period or 14 days whichever is later, falls in the same calendar month.

For example:

Effective date of first purchase Effective date of second purchase Total investment amount Qualify for wealth bonus? 5 March

RM5,000 lump sum investment in Fund A

16 March

RM15,000 lump sum investment in Fund B

RM20,000 Yes 10 April

RM2,000 regular premium endowment plan A

12 April

RM5,000 premium endowment plan B

RM7,000 Yes 10 April

RM2,000 regular premium endowment plan A

12 April

RM5,000 premium endowment plan B

RM7,000 No

Purchases made must be of the same wealth product type - What happens if I qualify for the wealth bonus more than once and the bonus periods overlap?

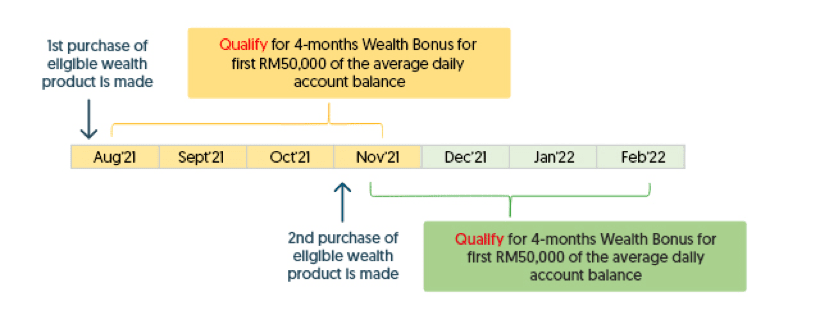

If you qualify for the wealth bonus 18 December 2020 onwards, for months in which there are overlaps, you will enjoy the maximum wealth bonus of 1.20%p.a. from the effective date of the latest eligible wealth product for 4 months.

Scenario

You purchase wealth product X in August 2021 and are eligible for 1.20%p.a. wealth bonus for 4 months (i.e., until November 2021). In October 2021, you purchase product Y and are eligible for 1.20%p.a. wealth bonus for 4 months. With this, you will receive the wealth bonus of 1.20%p.a. until January 2022, i.e., the latest qualifying month of the wealth bonus.

- Will my wealth bonus period get renewed when I pay for subsequent regular premiums?

For eligible wealth products with regular premium, only the first year annual premium is eligible. Any subsequent premium payment will not be eligible.

- How long can I enjoy the wealth bonus for if I qualify for it?

As long as you have subscribed to an eligible wealth product with an effective date of purchase after either (i) the free-look/cancellation period ends; or (ii) 14 days have passed, you will enjoy the wealth bonus according to the predetermined period below:

Eligible wealth product Wealth bonus earned Regular premium insurance 4 months

for eligible wealth products purchased from 18 December 2020 onwards

Unit Trust lump sum investment - Do I continue to get this wealth bonus if I redeem my investments or when they mature?

Yes. You will continue to get this wealth bonus.

- Do I continue to get this wealth bonus if I cancel my investment and/or policy during the free look/cancellation period?

No, you will not be eligible for the wealth bonus. The wealth bonus is accorded for only after the effective date of purchase, after the free look/cancellation period or 14 days, whichever is later.

- How can I pay for the eligible wealth products?

There are many ways to pay for eligible wealth products:

Insurance: Cash, credit card or Auto Debit (via OCBC account)

Unit trusts (lump sum investment): Cash, Auto Debit (via OCBC account) or EPF account for applicable funds

For information on the eligible wealth products?

For the full list of eligible wealth products, please click here

For insurance, please click here

For unit trusts, please click here

Alternatively, please leave your contact details here and we will get in touch with you.

Below are the examples of financial products that do not qualify for wealth bonus:

Dual Currency Investment (DCI)

Financing Facility

Foreign Exchange (FX)

Retail Bonds

Structured Investments

General Insurance

OCBC Stabiliser or ARIP-i

Insurance term plans

You may only open ONE OCBC Booster Account whether in own name or in joint names, where you are the primary account holder.

- If I have multiple Booster accounts, which account will my wealth bonus be paid to?

The wealth bonus will be paid to the account with the higher bonus amount. In the event the wealth bonus amount is the same for several accounts, then the wealth bonus will be paid to the account with the largest account number.

For New Customers

If you don't have an existing OCBC account, fill in your details to get us to contact you.

For OCBC Customers

If you have Internet Banking access with us, you can log in to OCBC Internet Banking and apply with just a few clicks.

Insurance Disclaimer

The above is for general information only and does not constitute any offer or solicitation or advice to buy or sell any insurance plans. It is not a contract of insurance. The precise terms, conditions and definitions of this insurance plan are specified in the policy contract. Insurance plans are not bank deposits and are not obligations of or guaranteed or insured by OCBC Bank (Malaysia) Berhad. These insurance products are obligations only of the insurance company and all claims and liabilities arising from the insurance products shall be referred to insurance company.

Buying a life insurance policy is a long-term commitment. An early termination of the policy usually involves high costs and surrender value payable may be less than the total premium paid. You should read the Product Brochure and Sales Illustration (obtainable from OCBC Bank) and you may wish to seek advice from your financial advisor, before deciding whether to buy this product.

OCBC Bank hereby disclaims any liability for any loss or damage (including without limitation, loss of income, profits or goodwill, direct or indirect, incidental, consequential, exemplary, punitive or special damages of any party including third parties) howsoever arising whether in contract, tort, negligence or otherwise in connection with the above plan or any products or services provided or offered by insurance company. OCBC Bank does not endorse or recommend any products or services offered, or represent or verify any information given by insurance company. Other terms and conditions apply. For the full terms and conditions, please refer to any OCBC Bank branches.

Unit Trust Disclaimer

This is for information only and does not constitute any offer, solicitation or advice to buy or sell unit trust funds. Please make your own independent evaluation of the suitability of the product and obtain advice from professional advisers including on tax, accounting and legal matters. We will not be responsible for the consequences of your reliance upon any opinion or statement contained herein or for any omission. These unit trusts are not bank deposits and are not obligations of or guaranteed or insured by OCBC Bank and are subject to investment risk unless otherwise specified. The investment risk includes general risks and specific risks as described in the Prospectus for the unit trust. Past performance is not indicative of future performance; the net asset value can go up or down. Investors should also note that the net asset value per unit and distributions payable, if any, may go down as well as up. The Prospectus has been registered with the Securities Commission, which takes no responsibility for its content. A copy of the Prospectus can be obtained at OCBC Bank's branches. Units will only be issued upon the receipt of application form referred to and accompanying the Prospectus. Investors are advised to read and understand the contents of the Prospectus, and if necessary consult their adviser(s), as well as consider the fees and charges involved before investing in the unit trusts.