- How different is the OCBC 360 Account-i from other savings account?

The OCBC 360 Account-i is a savings account that pays you bonus profit when you do all or any of these:

- Deposit at least RM500 every month.

- Pay at least 3 bills online every month.

- Spend at least RM500 on your OCBC Debit Card-i every month.

- How is the profit calculated?

You get 2 types of profit on your account balance every month.

- Base Profit: This profit is accrued daily based on your account's day-end balance and you will receive this at the end of the month.

- Bonus Profit: This profit is based on the first RM100,000 of your account's average daily balance for that calendar month when you fulfil all necessary requirements for “Deposit”, “Pay” and “Spend” pillars. You will receive by the 14th business day of the next month; truncated to 2 decimal places. Business day is a day that is not a public holiday in Kuala Lumpur or Saturday or Sunday.

- Can I open more than one OCBC 360 Account-i?

No, you may only open one account where you are the Primary Account holder. This means that if you already have one account in your single name, you will not be allowed to open a joint account as a primary accountholder.

- What happens if I close my OCBC 360 Account-i before the profit crediting date?

You will receive the prevailing Base Profit paid up to the day before the account closure. However, you will not be eligible for the Bonus Profit(s).

- Do I need to ‘time’ my eligible transactions?

Yes. There is occasionally a delay between when a transaction is performed by you, and when the transaction is posted to your account. Delays in the posting of transactions are due to various reasons, such as processing time, cut-off times, business days, etc. As such, only transactions that meet the qualifying criteria and are posted to your account within the month are counted towards payment of the Bonus Profit. The Bonus Profit will be paid out based on your average daily balance (up to a limit of RM100,000).

- How do I calculate the total profit earned for a month?

You may refer to the Product Information Sheet for an illustration. Please also note the different calculation conventions between Base Profit and Bonus Profit (summarised in the table below).

Type of profit Rate and computation Remarks Base Profit Accrues daily

Sum of (daily end balance x applicable rate for the day)

In the event of a rate hike or cut, the revised rate will be applied on the effective date. With this, the total Base Profit will be pro-rated. Bonus Profit Calculated at month-end

Average daily balance (ADB) x applicable profit rate at month-end

In the event of a rate hike or cut, the revised rate will be applied on the whole ADB amount of the month and the Bonus Profit is only calculated once at month-end.

OCBC 360 ACCOUNT-i

A high profit savings account for your everyday banking needs

Current PromotionReceive RM30 Welcome Cash Reward and earn up to 5% p.a. for 2 months on your newly opened OCBC 360 Account-i.

Find out more

Maximise your profit when you deposit, pay and spend with OCBC 360 Account-i.

Maximise your profit when you deposit, pay and spend with OCBC 360 Account-i.

Enjoy profit rate of up to 5% p.a. for 2 months when you perform your everyday banking activities.

(Exclusively for new-to-OCBC 360 Account-i customers)

Promotional period from 19 August to 30 November 2024.

You will earn a base profit of 0.10% p.a. on your entire account balance regardless of whether you fulfil the above Bonus Pillars.

Assuming you fulfil the above Bonus Pillars in the first 2 months upon account opening:

- Deposit & Welcome Bonus¹: You will earn a maximum Effective Profit Rate of 2.90% p.a. for one month.

- Deposit & Welcome Bonus¹ + Pay: You will earn a maximum Effective Profit Rate of 3.95% p.a. for one month.

- Deposit & Welcome Bonus¹ + Pay + Spend: You will earn a maximum Effective Profit Rate of 5.00% p.a. for one month.

1New-to-OCBC 360 Account-i customers are entitled to an additional 1.75% p.a. Welcome Bonus Profit on top of “Deposit” Bonus Profit of 1.05% p.a. for the first 2 months upon account opening if a deposit of at least RM3,000 is made each month. The eligibility criteria for “Deposit” Bonus Profit category remains unchanged.

The Bonus Profit and Welcome Bonus are capped at RM100,000 average daily balance for that calendar month. They are credited into the OCBC 360 Account-i within 31 business days from the start of the following calendar month.

Discover how much profit you can earn for the first 2 months on your New OCBC 360 Account-i opened during the promotional period.

Average daily balance in your account

Please check the appropriate boxes below:

OR

Profit earned

RM0.00

a month

Disclaimer

The amount is calculated on per month (31 days) basis and is for illustration purposes only.

The calculator is for your convenience only and you have chosen to use it and rely on any results at your own risk. OCBC Bank will not under any circumstances accept responsibility or liability for any losses that may arise from a decision that you may make as a result of using the calculator.

The profit rate of 3.25% a year is applicable on your first RM100,000 balance and will be paid by the 14th business day (not including Saturdays, Sundays and public holidays) of the following month. Only one (1) account is allowed per customer and with a minimum deposit of RM500.

Discover how much profit you can earn.

Average daily balance in your account

Please check the appropriate boxes below:

Profit earned

RM0.00

a month

Disclaimer

The amount is calculated on per month (31 days) basis and is for illustration purposes only.

The calculator is for your convenience only and you have chosen to use it and rely on any results at your own risk. OCBC Bank will not under any circumstances accept responsibility or liability for any losses that may arise from a decision that you may make as a result of using the calculator.

Exclusively for new OCBC 360 Account-i customers

Receive RM30 Welcome Cash Reward and earn up to 5% p.a. for 2 months on your newly opened OCBC 360 Account-i during the promotional period.

Promotional period from 19 August to 30 November 2024.

Note: Welcome Cash Reward is exclusively for new OCBC customers.

Terms and conditions apply.

Get rewarded together when you refer a friend who opens an OCBC 360 Account-i online

Invite your friends and family to open an OCBC 360 Account-i via the OCBC Malaysia Mobile Banking App using your unique referral code.

Promotional period from 19 August to 30 November 2024.

Apply instantly from the comfort of home and start using your OCBC 360 Account-i in no time at all! Download and sign up via the OCBC Malaysia Mobile Banking app today.

Open your OCBC 360 Account-i today

Common Questions

How do I qualify for the Bonus Profit – “Deposit” Pillar?

Just deposit cash/cheque amounting to RM500 and/or fund transfer from other banks. As suggestion, you may

- Set this account as your salary crediting account.

- Or set a recurring fund transfer from other bank account.

However, Base Profit and Bonus Profit are not considered deposits eligible for the Deposit Bonus Profit.

- How do I qualify for the Bonus Profit – “Spend” Pillar?

For Debit Card/-i

- The OCBC 360 Account-i must be tagged as the Fast Cash account for the debit card/-i.

- The joint accountholder’s debit card/-i spending is recognised (but must be tagged to the same OCBC 360 Account-i as the Fast Cash Account).

- Only net1 retail spending posted within the same calendar month will be eligible.

- Amounts not eligible for the Spend Bonus Profit:

- Annual fees and charges.

- Balance transfers.

- Amounts converted to the Installment Payment Plan or other similar plans.

- Retail transactions subsequently cancelled, voided or reversed at any time and for whatever reason.

1Net retail spending is defined as: Amount spent on retail transactions less amounts cancelled, voided or reversed in the calendar month

- In what situations would I not qualify for the Spend Bonus Profit?

- If there are any cancelled, voided or reversed transactions which result in your net1 spending for the calendar month falling below RM500.

- If your retail transaction has already been charged but not yet posted within the same calendar month. Retail transactions charged on the last few days of the month may only be posted in the following month.

- All FPX and DuitNow QR transactions.

1Net retail spending is defined as: Amount spent on retail transactions less amounts cancelled, voided or reversed in the calendar month

- If I spend RM200 on my credit card and RM300 on my debit card/-i, will I still be eligible for the Spend Bonus Profit?

No, only the net1 amount of debit card/-i spend within the same month will be eligible.

1Net retail spending is defined as: Amount spent on retail transactions less amounts cancelled, voided or reversed in the calendar month

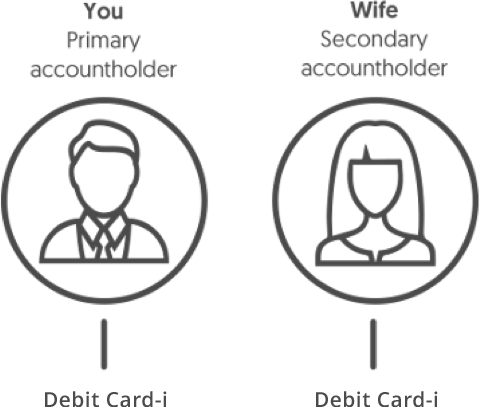

- My OCBC 360 Account-i is jointly held with my wife. If she spends RM550 on her own OCBC Debit Card-i, and I spend RM300 on my own debit card-i, will we be eligible for the Spend Bonus Profit?

- You and your wife jointly open a OCBC 360 Account-i.

- Your and your wife’s debit cards-i are tagged to OCBC 360 Account-i as your Fast Cash Account.

Your debit card-i spend (primary account holder) will be recognised Your wife's debit card-i spend (secondary account holder) will be recognised - Can my credit card spending qualify for the OCBC 360 Account/-i Spend Bonus Profit?

Type of Card Qualify for the OCBC 360 Account-i Spend Bonus? Credit Card No Debit Card Yes, if the OCBC 360 Account-i is tagged as Fast Cash Account Debit Card-i Yes, if the OCBC 360 Account-i is tagged as Fast Cash Account - Do I qualify for the Spend Bonus Profit if I top-up my e-wallet using the OCBC 360 Account-i?

Yes, if you top-up your e-wallet using your debit card/-i with the OCBC 360 Account-i as Fast Cash Account only.

If you top up your e-wallet via FPX and DuitNow QR transfers, you will not qualify for the Spend Bonus Profit.

- How do I qualify for the Bonus Profit – “Pay” Pillar?

You just need to pay any 3 UNIQUE bills with your OCBC 360 Account-i through OCBC Online Banking (e.g. transfer to OCBC credit facilities/ JomPAY/ Interbank GIRO / DuitNow) every calendar month.

For jointly-held accounts, eligibility for the Pay Bonus Profit will be based on the total number of payments done through the OCBC 360 Account-i within the calendar month, by either one or both accountholders.

- What is considered a bill to earn the Pay Bonus Profit?

All the billers listed under bill payment, JomPAY, and OCBC Home Financing payment.

- Do monthly instalments and Standing Instructions qualify for the Pay Bonus Profit?

Yes, monthly instalments and standing instructions qualify for the Pay Bonus Profit so long as it is made from the channel of OCBC Online Banking to any of the below:

- OCBC/OCBC Al-Amin home loan or financing facility.

- Any account with any bank/financial institution other than OCBC/OCBC Al-Amin.

- Participating billing organisations.

- Are there any payment channels that are not qualified?

Only payments made via the Financial Process Exchange (FPX) and DuitNow QR platforms do not qualify.

Payments made online, Interbank GIRO and DuitNow through the OCBC Online Banking channel qualify.

- If I pay my insurance premium or any of my bills from my OCBC Debit Card-i, am I eligible for the Pay Bonus Profit?

No. Payments from your OCBC Debit Cards-i are eligible for the Spend Bonus Profit instead. To qualify for the Pay Bonus Profit, you must make the payment(s) from your OCBC 360 Account-i.

- I made 3 payments to my loan facility account. Why did I not receive my Pay Bonus Profit?

Multiple payments within the same month to the same merchant, payee, account and/or billing organisation will be deemed as ONE bill payment. However, if you have made multiple payments to different accounts within the same billing organisation and each payment may be uniquely identified to a distinctive account, you will be eligible for the Pay Bonus Profit.

- Are there any payments that are not considered eligible?

Any payments that are subsequently cancelled, reversed or voided will not be eligible for the Pay Bonus Profit.

- Can I use JOMPAY on the Mobile Banking Application?

Yes, but you must register a JomPAY biller on Internet Banking first so that it will appear on your Mobile Banking Application and thereafter, you may use JomPAY to pay your bills via the Mobile Banking Application.

Note: Billers must be registered on Internet Banking for them to appear on the Mobile Banking Application. You cannot add Billers via the Mobile Banking Application.

How to earn the Deposit bonus profit

-

Set this account as your salary crediting account; OR

-

Set a recurring fund transfer from other bank account.

How to earn the Pay bonus profit

-

Use OCBC Internet Banking to pay your credit cards, loans/financing or bills from over 10,000 billers with JomPay.

-

Bills include your credit cards, loans/financing and monthly payments with OCBC Bank/OCBC Al-Amin or other banks.

How to earn the Spend bonus profit

Combine your spending across all your OCBC Al-Amin Debit Card-i to qualify

Note: Only eligible transactions that appear on your debit card account within the calendar month will qualify for this. Transactions that have been terminated, voided, reversed or cancelled will be excluded.

For New Customers

Scan the QR code to download the OCBC Malaysia Mobile Banking app to open your account instantly.

Download the OCBC Malaysia Mobile Banking app to open your account instantly.

For OCBC Bank Customers

Please apply via OCBC Internet Banking (Login > Open an account > Savings) or visit any OCBC Bank branches.

Please apply via OCBC Internet Banking (Login > Open an account > Savings) or visit any OCBC Bank branches.

Log in to Internet BankingDownload OCBC Malaysia Mobile Banking app

Scan the QR code to download the app on the Apple App Store or Google Play Store.

How referrals work

Just follow these simple steps:

- Invite friends and family: Login to your OCBC Malaysia Mobile Banking App, share your unique referral code and invite your friends and family to open an OCBC 360 Account-i online.

- Sign up: Your friend signs up for an OCBC 360 Account-i as a new-to-OCBC Bank customer by using your unique referral code and making a minimum deposit of RM500 via FPX within 30 days from the account opening date.

- Get rewarded: Both you and your friend will receive RM30 each as a reward when all criteria are met.

Before you start, remember to let your friends and family know about the OCBC 360 Account-i and get their consent to receive your invite.

Promotional period from 19 August to 30 November 2024.

Terms and conditions apply.

A member of PIDM. Protected by PIDM up to RM250,000 for each depositor.